Q: Hi Kyle, I see fixed rates moving up and down in nearly every time I check your website for the latest on rates, but it doesn’t seem to be congruent with the information that I hear on the news regarding the economy. How do the banks determine the rates for a fixed rate (and variable rates)? Thanks.

A: Fixed rates and variable rates are determined by different factors and are largely unrelated on a small scale. I’ll go over the differences of how they are calculated, and having an understanding of this will likely make it easier for you to understand why news you hear may not have the effect on rates you anticipate.

Fixed Rates:

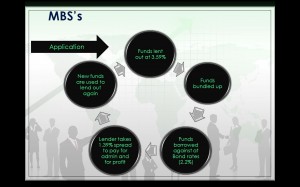

Fixed rates are determined mainly by bond yields. This is because of the way that the majority of mortgages are handled once you as a customer receive your mortgage money. Mortgages are often sold as what is called an MBS, or Mortgage Backed Security. Basically, banks lend to people like you and me and then sell the mortgage out the back door, paying an investor a smaller rate of return. This rate of return is likely to be close to a bond yield with the same term.

Usually lenders are looking for a 1.2% – 1.5% spread on top of current bond rates to determine their fixed rates. As of Feb 1st, 2011, a 5 year bond rate was 2.49%, which would imply fixed rates of 3.69% – 3.99%. This is almost exactly the range we see today, with most competitive rates at 3.64% and less competitive lenders at 3.99% (and some in between, of course). Although these spreads are fairly consistent, we have seen spreads far and above 1.5%, most recently during the subprime meltdown in Oct 2008 when bond yields were dropping, and yet fixed rates were increasing (due to increasing spreads).

You can follow bond yields daily by going to http://www.financialpost.com/markets/data/money-yields-can_us.html.

Variable Rates:

There are two factors to consider when obtaining a variable rate:

– Prime Rate (determined essentially by the Bank of Canada, although banks can change the way their Prime rate is determined)

– Discount to Prime (or premium)

The Bank of Canada meet every 6 weeks to determine what is called the overnight lending rate (this is what rate banks can trade for after hours to balance books) which in turn affects the prime rate. In rate occurences the BoC may call for emergency rate hikes or reductions, which we saw during the heat of the subprime crisis. The Bank of Canada has a number of items on its agenda, but here are some of the most important factors:

– Inflation (they like to keep this below 2%)

– Growth

– Imports and Exports

– Dollar valuation

Raising the prime rate will typically lower inflation and growth (less people are borrowing money to purchase goods), and increase the dollar value relative to other countries (higher returns means more demand for Canadian money). The impact on imports and exports can vary quite a bit, but a high dollar and high inflation will lower the demand for Canadian goods. More often than not economists will predict quite accurately what the BoC will do prior to their meetings, so you should know if your rate is going to rise or not.

The other factor on a variable rate is the discount. Currently best discounts are Prime – .75%, whereas most lenders are about Prime – .60% or Prime – .65%. Lenders resort to the LIBOR rate (Lond InterBank Offer Rate, similar to the Canadian overnight lending rate in Europe) to help determine these discounts. Lenders typically are looking for a 120-130 basis point spread (1.2% – 1.3%). Here is the formula:

Variable discount = Prime Rate – Spread – 30 day LIBOR = Discount

So, using today’s rates as an example: 3% – 1.2% – 1.2% = .6% discount

You can check the LIBOR rate here:

Be the first to post a comment.